At Nur Funds, we offer a diverse range of income-generating investment options tailored to meet your financial goals.

Each opportunity is meticulously evaluated to ensure adherence to Islamic principles, providing you with peace of mind and ethical returns.

Historically, halal investments have offered a rare combination of stability, ethical integrity, and long-term wealth generation—traits not commonly found in conventional asset classes. By aligning with Islamic principles, these investments provide opportunities that are both financially rewarding and ethically responsible.

Halal investments have historically delivered a balance of lower volatility than stocks and higher potential returns than traditional fixed-income assets. This stability can serve as a foundation for your portfolio, reducing the unpredictability of conventional markets while fostering steady financial growth.

One of the most attractive aspects of halal investing is the ability to generate consistent, tangible income. Whether through rental income from residential properties or profit-sharing in ethical business ventures, these investments offer a reliable stream of earnings without reliance on interest-based models.

Halal investments prioritize real assets and ethical business practices, making them less susceptible to speculation and sudden market fluctuations. This focus on tangible value and long-term growth helps investors mitigate risk while maintaining financial security, even during economic downturns.

Nur Funds is committed to leveraging macroeconomic trends and emerging opportunities that align with Islamic financial principles. From high-demand residential properties in thriving communities to ethically structured private capital ventures, our portfolio is designed to build sustainable, long-term prosperity for our investors.

At Nur Funds, safeguarding your personal and financial information is our top priority. We implement industry-leading security measures to ensure your data remains confidential and protected from unauthorized access.

Our Commitment to Data Security:

At Nur Funds, we employ a diversified approach to construct resilient portfolios tailored to our investors’ objectives and risk preferences. By integrating various investment strategies, we aim to harness market potential and deliver consistent, strong results.

Active projects

Completed projects

Total portfolio value*

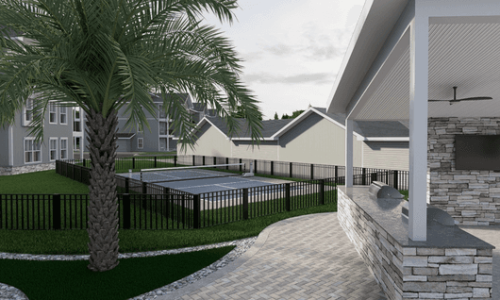

With a boom in remote work and business-friendly local governments courting employers, more affordably-priced suburban apartment communities have generally experienced stable or growing demand. We’ve paid a lower price for these investments relative to their earnings, and expect a higher income yield in the near term, as well as the potential for greater appreciation over the long term to the extent that demand increases in the future.

Propelled by the popularity of e-Commerce, a growing need for logistical facilities and last-mile distribution centers near largely populated areas has made industrial space an attractive long-term investment. Our goal with these investments is to generate a consistent income from commercial tenants, and position ourselves to capture any appreciation in the value of these properties in supply-constrained areas.

At Nur Funds, we are dedicated to empowering individuals by providing Shariah-compliant providing Halal investment opportunities that promote ethical growth and financial well-being.

© 2025 Nurfunds All rights reserved / Powered by Ecomcup